Everything Real Estate In

Charlottesville, VA

Mission Statement & Core Values

We aim to delight and surprise our clients, deliver exceptional service, and exceed their expectations at every step in the transaction. Our goal is to make the real estate process memorable and one that our clients want others to experience.

Story House Real Estate is committed to:

- Guiding each client through the real estate experience with patience and an open, frequent line of communication.

- Helping each client fulfill their dream of buying or selling their home in a personal, relaxed, yet professional manner.

- Holding ourselves to the highest professional and ethical standards.

- Providing all team members a fun, stable, fulfilling environment with the opportunity for personal growth.

- Helping our clients make prudent real estate decisions, and in the process prove worthy of their friendship so that we may become long-term friends and advisors.

- Providing our clients with comprehensive information and expert advice.

- Being the LEADER in the Charlottesville Real Estate Industry.

Featured Listings

About Us

Our diverse team is here to help you.

Our Areas

New Listings

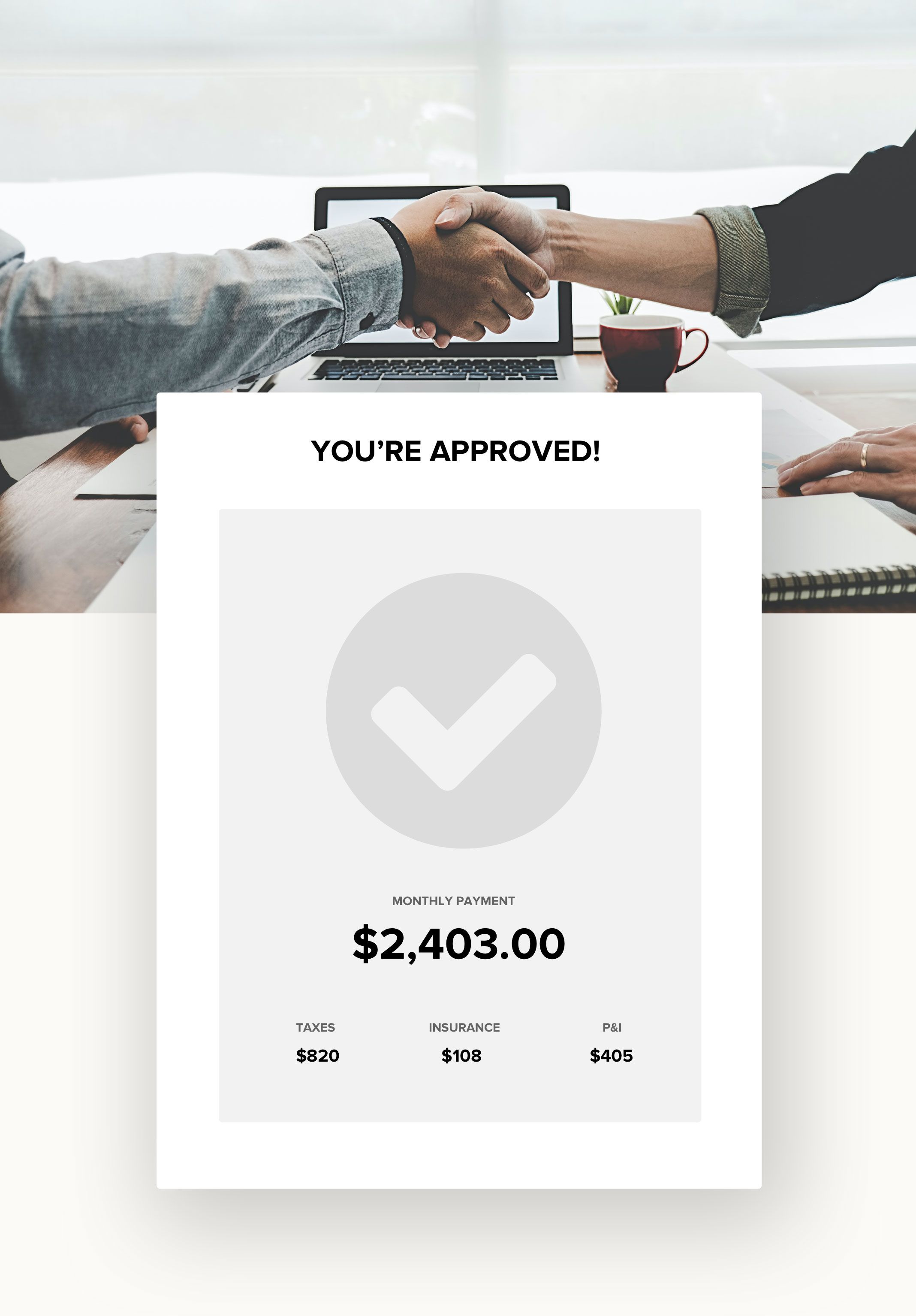

Get Pre-Approved

Before you start looking for a home to buy, we recommend getting pre-approved for a loan amount. We’ll help you find the best local loan officer to get you competitive rates and the programs that best fit your individual needs. Our preferred lenders are dedicated to their borrowers, and work together to provide the home loan options and customer service you deserve. You’re assured of a home financing experience that will exceed your expectations from start to finish. Let’s get you connected with a lender today!

Let's Get Started